how much does the uk raise in taxes

How much does the UK raise in tax compared to other countries. The richest 10 pay over 30000 in tax mostly direct income tax.

The government says the changes are expected to raise 12bn a year.

. The UK is more of an outlier at the median especially for SSCs than it is for top earners. One of the EU15 countries that raise more tax than the UK. From 168 billion in 202122 to 6 billion in 202223.

The UK has one of the more progressive income tax and SSC systems in the EU15 in the sense that average rates are high at the top relative to the median. They receive around 2000 in benefits. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person.

UK Government Expenditure Statistics. That would be an extra 91000 in tax revenue per person. However from July 2022 the point at which.

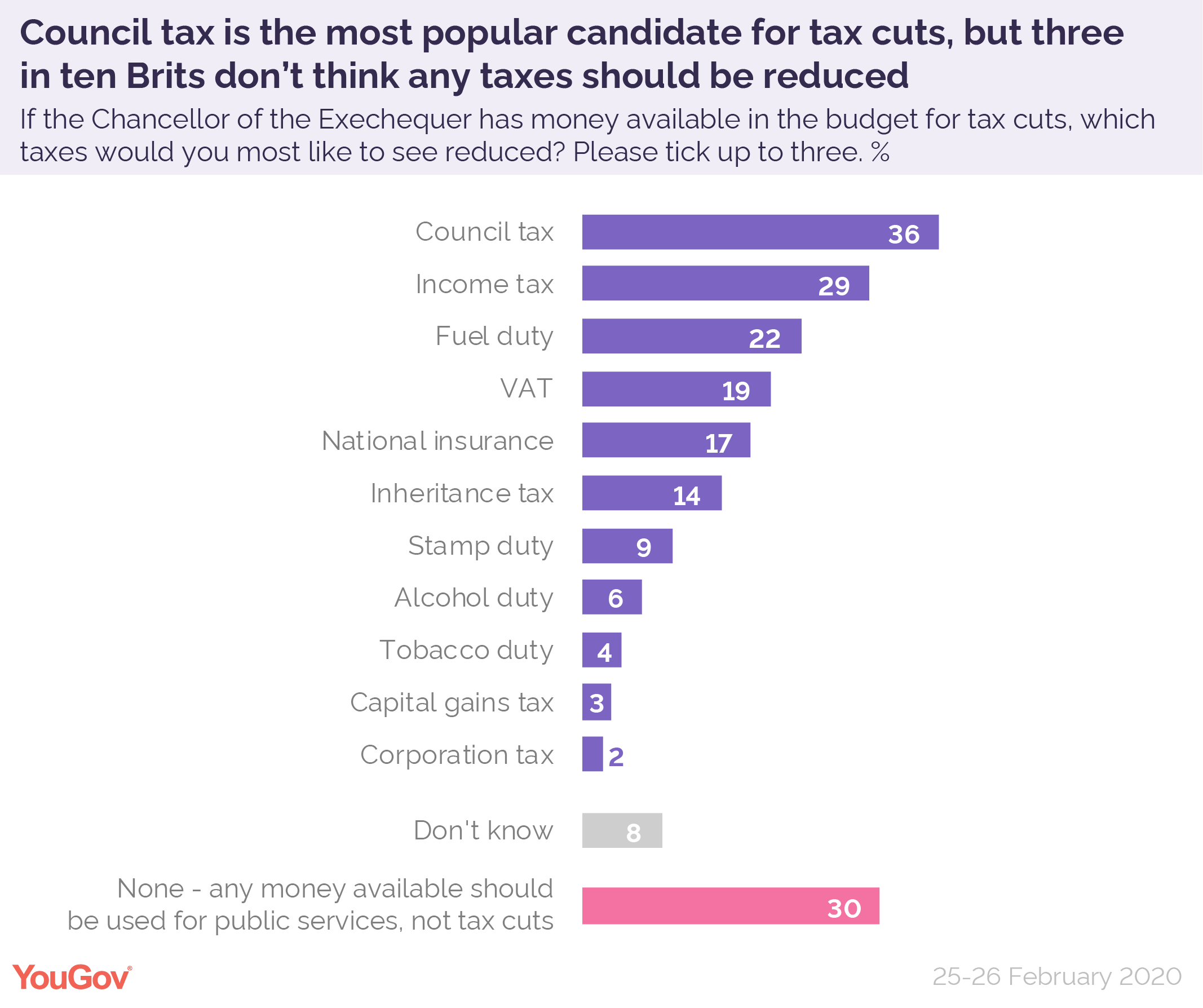

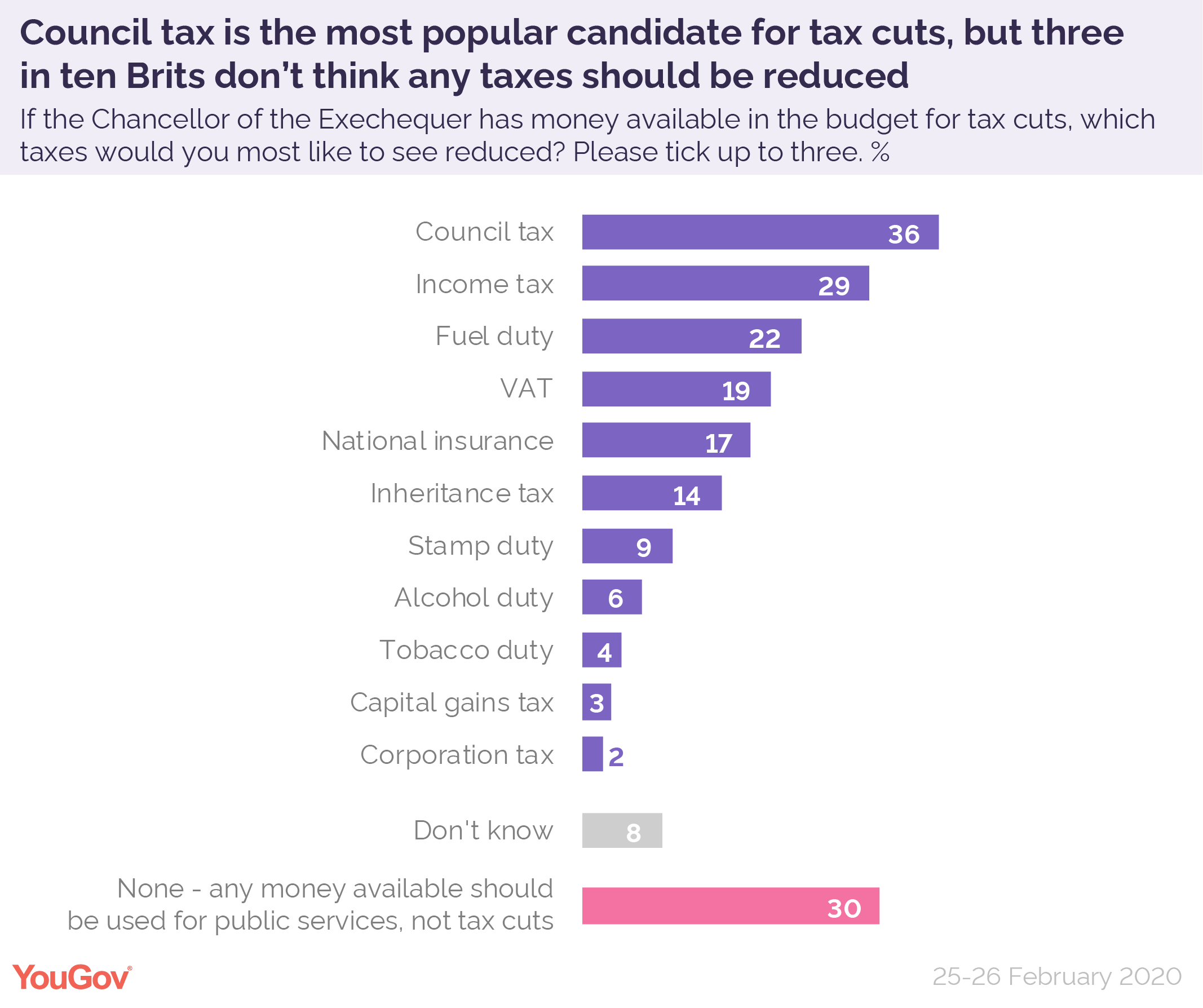

What is the tax increase for. Much of the revenue initially. The average Band D council tax set by local authorities in England for 2020-21 is 1817⁶.

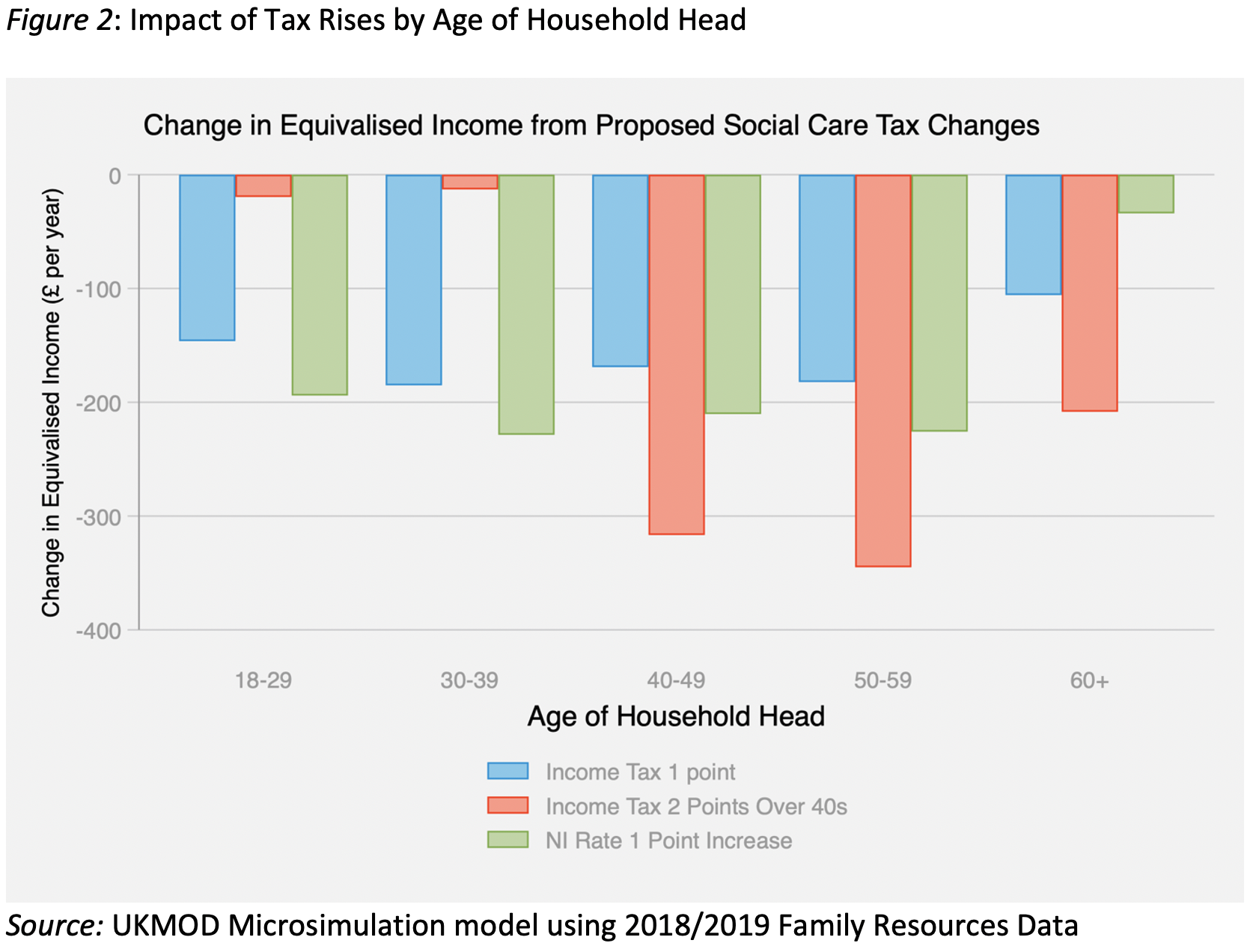

The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-. The amount where people start to pay National Insurance contributions NIC is to increase from 9880 to 12570 from July 6. A 1 tax on the use of the policy would be raised by Labour the party claimed.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. But receive over 5000 in tax credits and benefits. 201920 was the first time since 201011 that spending as a percentage of GDP has increased.

However inequality in the UK has increased since 1980. How much does the UK raise in tax compared to other countries. Ministers say that the tax change will benefit around 30 million.

Your local authoritys website will list the council tax amount for each band. Government expenditure as a percentage of GDP in the United Kingdom was at 354 in 201920. This was an increase of 04 compared to the previous year.

From 229 in total income taxes it is anticipated that receipts will increase. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019. UK tax revenues were equivalent to 33 of GDP in 2019.

The threshold had already been due to increase from 9568 to 9880 on 6 April 2022. Overall the average household pays 12000 in tax and receives 5000 in benefits. A 40bn tax rise would be the equivalent of an increase of 7p on the basic rate of income tax or an increase of six per cent on VAT he said.

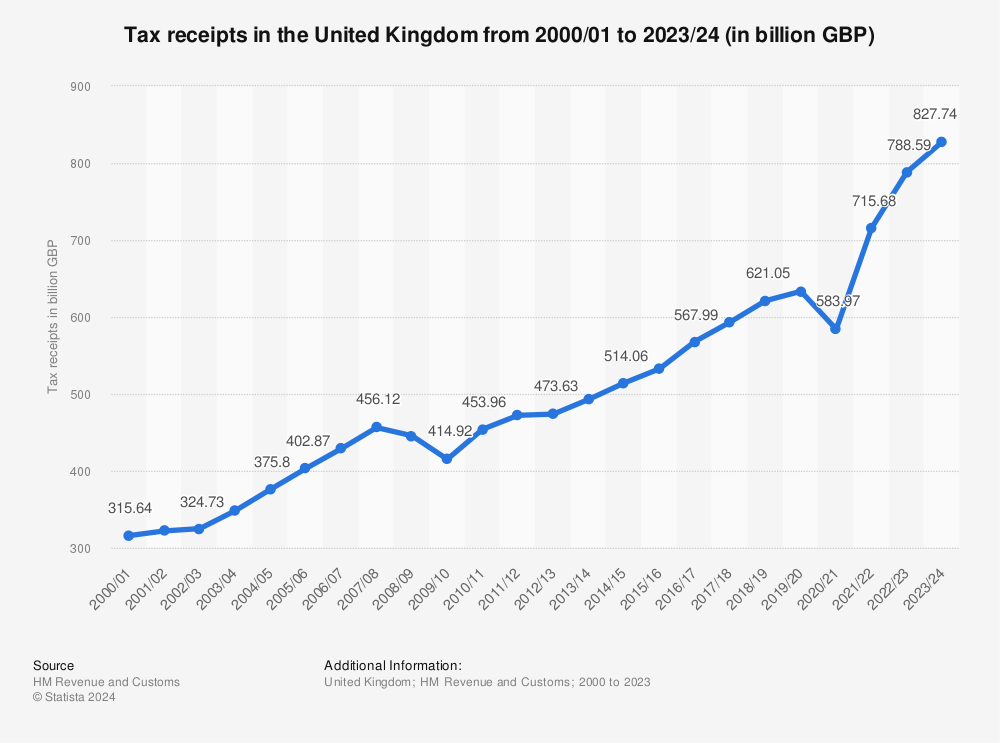

In 202122 UK government raised over 915 billion a year in receipts income from taxes and other sources. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont.

This is equivalent to around 39 of the size of the UK economy as measured by GDP which is the highest level since the 1980s. By 2025 26 billion people will have access to. How much does the UK government spend each year.

The Chancellor is specifically understood to be looking at hiking corporation tax from 19 per cent to 24 per cent to raise 12billion next year and 17billion in 202324. Total tax receipts in 201718 are forecast to be 690 billion. This represented a net.

Johnsons office favours a 1 rise in the tax while the finance ministry is possibly looking at a higher rate of up to 125 the Telegraph. You can check which local authority your home is in by entering your postcode on the GOV. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

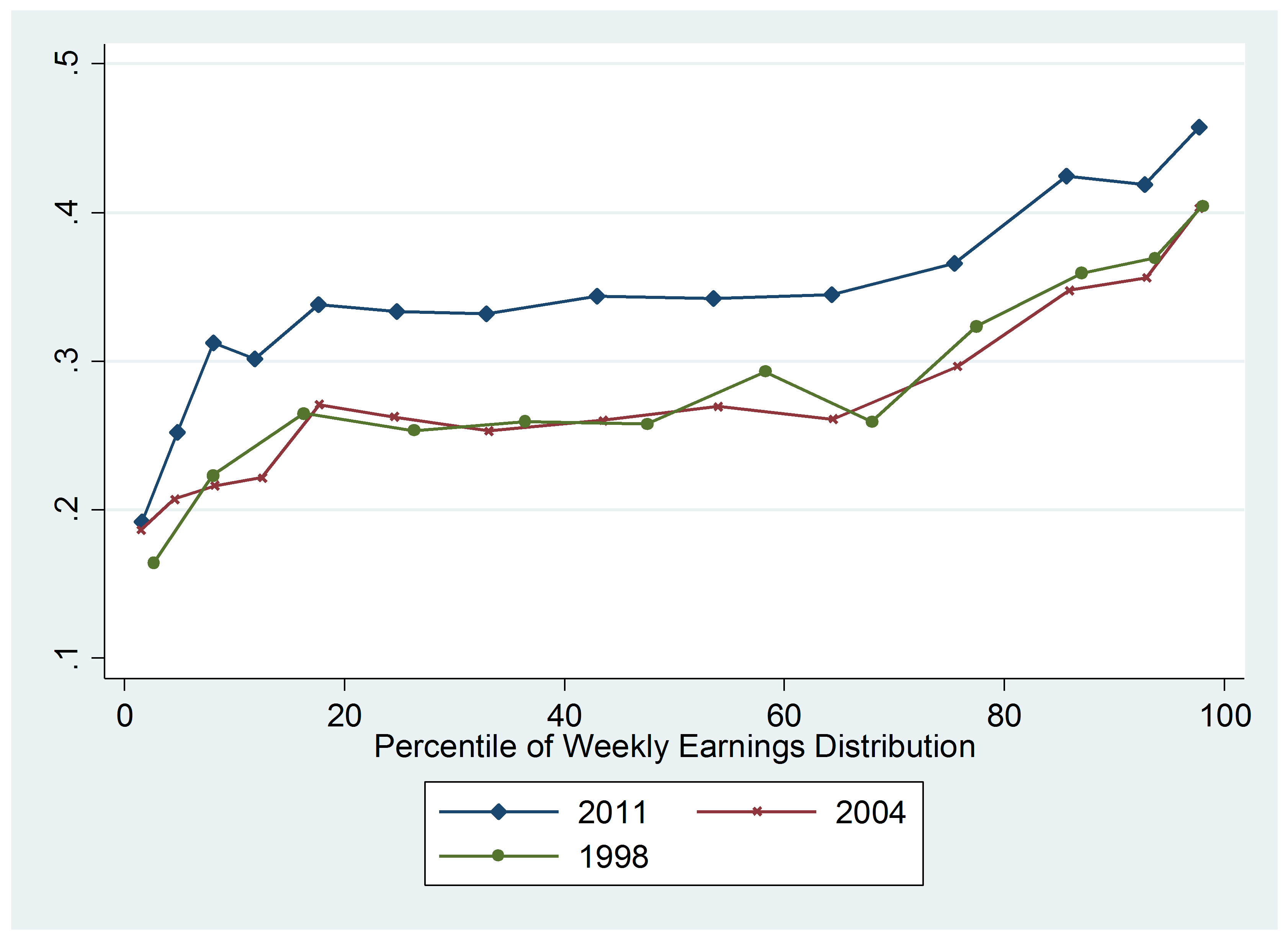

Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. In line with inflation there will be an increase in allowances and the basic rate limit. Mr Sunaks announcement meant a further 2690 lift saving 267 over the.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. Overall the average household pays 12000 in tax and receives 5000 in benefits. In 202122 government of the United Kingdom is expected to receive 820 billion British pounds of public sector current receipts with 198 billion British pounds coming from income tax as well as.

From April 2022 anybody earning more than 9880 a year will pay 125p more in the pound.

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Income

Richard Burgon Mp On Twitter Richard Investing Twitter

People Are Making Fun Of Rich People Who Are Afraid Of Biden S Tax Plan 46 Pics Cool Things To Make How To Plan Rich People

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Pin On Making Money Online The Right Way For Anyone

Budget 2020 What Tax Changes Would Be Popular Yougov

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

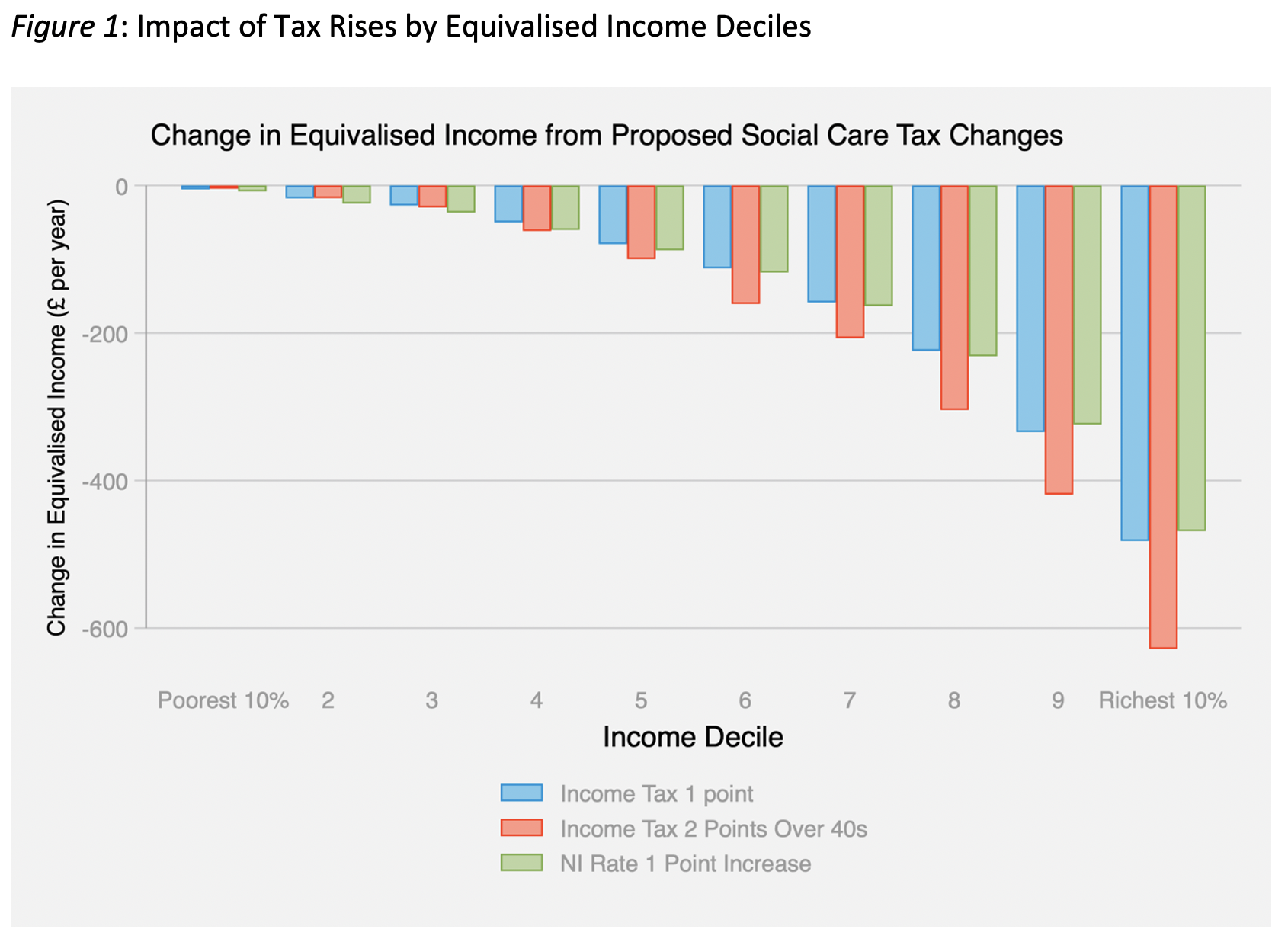

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

The Top Rate Of Income Tax British Politics And Policy At Lse

Types Of Tax In Uk Economics Help

Why It Matters In Paying Taxes Doing Business World Bank Group

How To Pay Taxes On A Credit Card And Get Rewards Business Credit Cards Credit Card Payoff Plan Credit Card

It S Time To Love Payroll This September Details Here Https Fmpglobal Co Uk Blog Its Time To Love Payroll This September Utm Cam Payroll Taxes Payroll Blog

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Income Tax In The Uk And France Compared Frenchentree

Magoz Illustration About Why Women S Products Often Cost More It S Unfair And It S Called The Pink Tax Illustration For Papel Aug Pink Tax Pink Creative Ads

Helen O D On Twitter Historical Newspaper Newspaper Headlines Newspaper